🗓️

Feb 16, 2026

Tax Reassessment at Reversion for CRE Properties

A tax reassessment occurs when a taxing authority updates a property’s assessed value, typically after a change in ownership, to reflect current market value. This reassessed value becomes the basis for future property tax bills.

In California, Proposition 13 limits annual increases in assessed value to a maximum of 2% per year, regardless of how much market value grows. As a result, long-held properties often carry tax bases that are well below current market value. That’s fine for modeling current operations, but it can create issues at exit.

When a property is sold, it changes hands. In many cases, that sale typically triggers a reassessment, meaning the buyer inherits a new tax basis rather than the seller’s historical one. This matters directly for reversion (exit) value.

In a financial model, reversion value is usually calculated by applying a direct cap rate to forward NOI. If property taxes are carried forward based on in-place assessments instead of market value, NOI is overstated and so is value.

This same logic shows up on the debt side. When lenders underwrite loans, they evaluate the asset as if they may need to take ownership in a downside scenario. Appraisals are based on market value, and taxes are often underwritten as if the property were reassessed, even in refinance scenarios. This reduces lender risk regardless of whether taxes are immediately reset.

Illustration

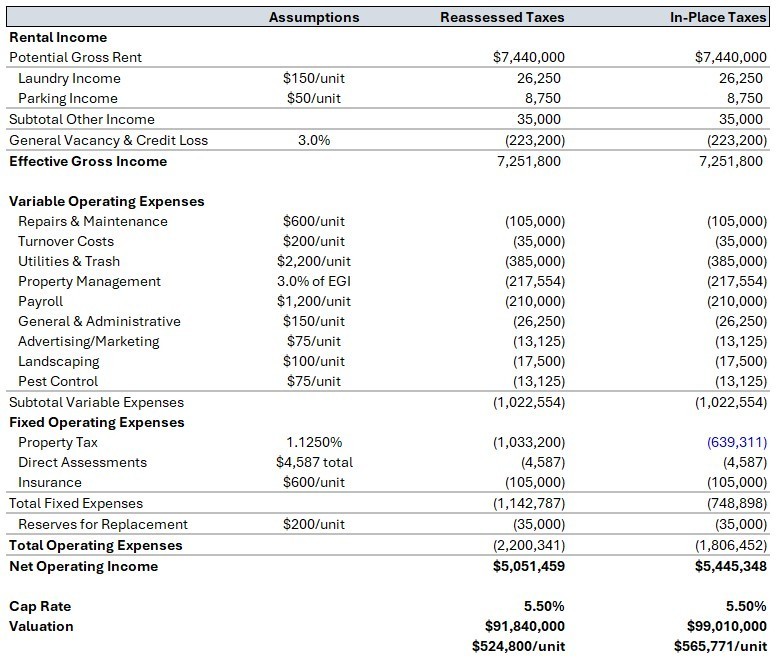

Assume two identical income statements for a 175-unit apartment complex acquired years ago and now worth significantly more. The only difference between the two statements is property taxes.

One reflects in-place taxes of $639,311, while the other reflects reassessed taxes of $1,033,200. That $393,889 difference flows directly through to NOI, resulting in a 7.8% difference in value using a 5.50% exit cap rate.

Under typical loan terms (5.25% interest rate, 30-year amortization, 1.25x DSCR), loan proceeds supported by in-place taxes would be approximately $4.8 million higher than when underwriting reassessed taxes.

Reversion assumptions drive a meaningful portion of total return in most models. If taxes aren’t reassessed at exit, NOI is overstated, value is overstated, and risk is understated. If a deal only works because in-place taxes are carried forward at reversion, that’s a signal worth paying attention to.